Financial statement issues may make plan terminations problematic even for some overfunded DB plans

As we have discussed, when a sponsor terminates a defined benefit plan, the cost of the plan termination will typically exceed the book value of plan liabilities by 15%-35% for non-retirees and 5%-10% for retirees.

As we have discussed, when a sponsor terminates a defined benefit plan, the cost of the plan termination will typically exceed the book value of plan liabilities by 15%-35% for non-retirees and 5%-10% for retirees.

This write-up of liabilities reflects the cost of buying annuities, attributable to annuity carrier regulatory (and business) overhead and profit margin, carrier underwriting practice that generally uses more conservative valuation and risk assumptions, and the Department of Labor requirement that sponsors must buy the “safest available annuity.” There will also be additional administrative costs related to the termination process.

Some firms may, however, find that, even where the plan is “sufficiently” overfunded to finance these additional costs, they still can’t afford to terminate it, because of the effect of the termination on their financial statements.

In this article we summarize what effects termination of an overfunded plan may have on a sponsor’s financials and then work through a case study illustrating those effects. We conclude with a (very) brief discussion of Plan B.

The four plan termination financial statement “hits”

When a sponsor terminates an overfunded DB plan and buys annuities to settle plan liabilities, it may take up to four “hits” to its financials:

Hit #1: Plan liabilities may have to be written up (as discussed above), reducing net worth.

Hit #2: That write-up typically will have to be run through the income statement, generating a (non-recurring) expense and reducing net income.

Hit #3: Unrecognized losses may also have to be run through the income statement. The long-run decline in interest rates (from 1982 to the present) has, for DB plan sponsors, generated interest rate-rated losses on plan liabilities, compounded by subpar asset returns (5% returns on stocks over the past 20 years). Accounting rules allow sponsors, in most cases, to defer recognition of these losses. Any remaining “deferred losses” are recognized on the income statement at plan termination.

Hit #4: Any “pension income” generated by the plan surplus will disappear – reducing future net income.

These financial hits – particularly for earnings sensitive companies – may make the cost of terminating an overfunded plan prohibitive.

Case study – financial statement consequences of termination of an overfunded plan

To illustrate how significant this issue may be for the sponsor of an overfunded plan, let’s walk through a typical example.

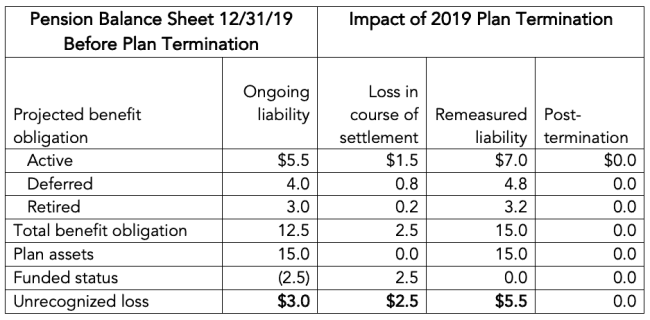

ABC company sponsors a DB plan that has (as of year-end 2019) $12.5 billion in liabilities and $15.0 billion in assets. So, ABC’s plan is generally understood to be “overfunded” by $2.5 billion. It also has $3.0 billion in unrecognized losses (this is the typical situation for pension sponsors and is due to declines in market interest rates and underperformance of plan assets over the past two decades).

Table 1 illustrates how a plan termination would affect ABC Company’s balance sheet.

Table 1: ABC Company Balance Sheet at 12/31/2019 ($ billions):

Absent plan termination, the plan provides the sponsor a $2.5 billion balance sheet asset (the funding surplus). These surplus assets are used to finance the additional cost of annuity purchases (also $2.5 billion, a 20% write-up which is typical based on the composition of plan liabilities).

$5.5 billion hit on the 2019 income statement

Both the $2.5 billion additional cost of annuities settling plan obligations and the plan’s previously-existing unrecognized loss of $3.0 billion must, on plan termination, be run through the sponsor’s income statement. In total, the company must record a $5.5 billion pre-tax charge to terminate the plan at the end of 2019.

Ongoing hit to the income statement

On top of this, the pension income the overfunded plan was generating will, after the 2019 plan termination, “disappear” from future income statements.

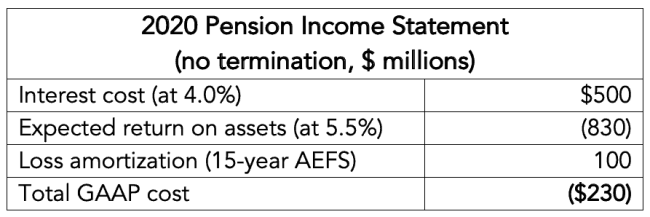

Table 2 illustrates the “pension income” that the plan would generate if it were _not_terminated in 2019. (We assume the plan uses a 4.0% discount rate to measure liabilities, a 5.5% expected return on assets, and minimum amortization based on 15 years of average expected future service.)

Table 2: ABC Company Income Statement:

If the plan is terminated in 2019, the sponsor loses $230 million in pre-tax annual pension income in 2020 and beyond on top of the $5.5 billion pre-tax charge in 2019.

* * *

Thus, as we described above, the sponsor here has taken four financial statement “hits” –

Hit #1: Plan liabilities are written up, reducing sponsor net worth by $2.5 billion.

Hit #2: That write-up is run through the income statement, generating a (non-recurring) expense of $2.5 billion.

Hit #3: Unrecognized losses from prior years must also be run through the income statement when the plan is terminated, generating a (non-recurring) expense of $3.0 billion.

Hit #4: $230 million in “pension income,” a recurring item generated by the (no longer existing) plan surplus, disappears.

Plan B: maintain an ongoing plan

If the sponsor does not assign any value to pension surplus (a view propounded by many consultants), there may be little objection to using the surplus to fund the incremental cost of terminating the plan. But, even in this case, the accounting impact can be prohibitive. What is the alternative?

The most obvious Plan B is for the sponsor is to continue to maintain the plan.

The question for sponsors then becomes, what are the best asset-liability management and plan design strategies for the ongoing plan? In that regard, three objectives will be of overriding importance, minimizing (1) PBGC premiums, (2) plan administrative costs and (3) financial statement volatility – all topics that we regularly cover.