Annuity Purchase Update: December 2020 Interest Rates

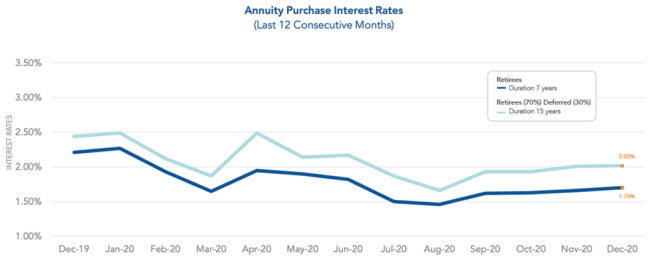

Pensions experienced their strongest month of the year in November. The average duration 7 annuity purchase interest rates increased 4 basis points and average duration 15 rates increased 1 basis point since last month as seen in the below graph titled Annuity Purchase Interest Rates.

Executive Summary

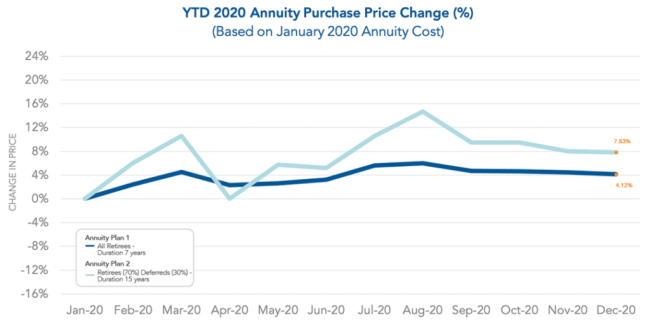

Year-to-Date annuity purchase prices have been volatile and are now higher for both Annuity Plan 1 and Annuity Plan 2.*

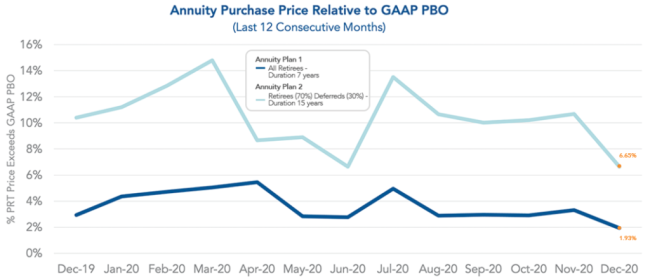

Annuity purchase prices relative to GAAP PBO liabilities have also been volatile but are now in line with historical expectations.

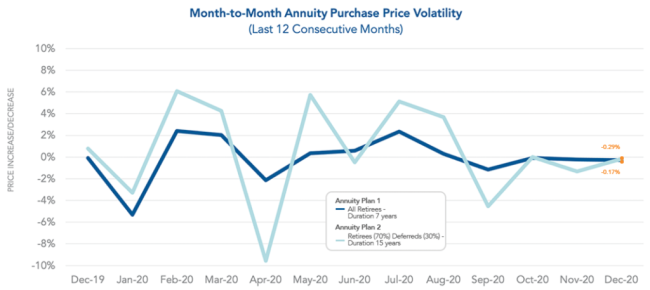

This past month annuity purchase prices declined 0.29% for Annuity Plan 1 and 0.17% for Annuity Plan 2.

Plan funded status has generally declined for pension plans in 2020 and PBGC premiums will increase next year.

December 2020 Rates | ||

Duration: | 7 Years | 15 Years |

Range Rate: | 1.36% – 2.12% | 1.52% – 2.42% |

Average Rate: | 1.70% | 2.02% |

Average Rate Past Month Increase/Decrease: | 0.04% | 0.01% |

Average Rate YTD Increase/Decrease: | - 0.57% | - 0.47% |

December 2020 Plan Tracker | ||

Plan: | Plan 1 | Plan 2 |

Annuity Purchase Price – YTD: | +4.12% | +7.83 % |

Annuity Purchase Price – Past Month: | - 0.29% | - 0.17% |

% Annuity Purchase Price Exceeds GAAP PBO: | 1.93% | 6.65% |

% Annuity Purchase Price Exceeds GAAP PBO – Past Month: | - 1.39% | - 4.03% |

Narrative

As mentioned in the November 2020 Pension Finance Update, pensions experienced their strongest month of the year. The average duration 7 annuity purchase interest rates increased 4 basis points and average duration 15 rates increased 1 basis point since last month as seen in the below graph titled Annuity Purchase Interest Rates.

Pension plans have experienced unprecedented volatility in 2020. While the market volatility has caused the treasury rates to drop dramatically, the spread between treasury bonds and the bonds insurance companies invest in have widened. The widening of this spread typically tells us that now would be a good time for pension plans to purchase annuities. Furthermore, we’ve observed aggressive pricing from the insurance companies in 2020. We have completed several annuity purchases in 2020 where the retiree premium matched GAAP liabilities.

Pension plan funded statuses have generally declined in 2020 and PBGC premiums will increase in 2021. Now may be the perfect time for your plan to reduce premiums by reducing headcounts.

Similar to the fourth quarter of previous years, insurance companies are experiencing increased demand for annuity purchases in Q4 2020. Some insurance companies are already nearing their capacity limit. For plan sponsors wishing to settle liabilities in 2020, we believe marketing your liability to the PRT market immediately to be a prudent measure.

History demonstrates annuity purchase interest rates fluctuate over time with varying degrees of peaks and valleys. We observed an upward trend in both duration 7 and duration 15 annuity purchase rates at the end of 2019. However, due to the COVID-19 pandemic, annuity purchase rates dropped in Q1 2020, and began to increase during the last quarter of 2020. Plan sponsors should consider getting their data in order for a Pension Risk Transfer. Implementing a Pension Risk Transfer strategy can help a plan sponsor fulfill organizational goals, including reducing volatility in financial disclosures due to volatile interest rates.

The spread of annuity purchase prices above the GAAP projected benefit obligation (PBO) remained fairly stable during 2019. This spread was around 3% for Annuity Plan 1 and 11% for Annuity Plan 2. In 2020, the spread has demonstrated more volatility due to the COVID-19 pandemic. As of December 2020, the spread for Annuity Plan 1 is 1.93% and the spread for Annuity Plan 2 is 6.65% as seen in the below graph. Relative to GAAP, an increase in annuity purchase rates generally lowers annuity purchase prices. Keep in mind that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs. Future overhead costs would narrow the spread, though the extent is plan specific.

This past year significant month-to-month cost volatility has persisted. In the past month the annuity purchase price for Annuity Plan 1 dropped 0.29% and Annuity Plan 2 dropped 0.17% as seen in the below graph. Timing an early entrance to the insurance market is a crucial part of the planning stage because of the consistent short-term volatility of annuity pricing. Sponsors can take advantage of favorable fluctuations in a volatile market by connecting with an annuity search firm early.

Additional Risk Mitigation Strategies to Consider

During these volatile times, one strategy plan sponsors have utilized is borrowing to fund their pension plan. The recent activities in the markets will negatively effect the funding status of plans and therefore may increase your plan’s PBGC Variable Rate Premium. In 2020, the PBGC Flat-Rate Premium will increase to $83 per participant, the Variable-Rate Premium will increase to 4.5% of unfunded vested benefits, and the Variable-Rate Premium Cap will increase to $561 per participant. As part of managing a pension plan, sponsors should consider a borrow-to-fund solution for de-risking their plan.

By borrowing to fund, plan sponsors can exchange volatile pension liabilities in return for a fixed low interest rate loan. The benefits this funding can have include reducing PBGC premiums and accelerating tax deductions, as well as allowing plan sponsors to focus more on their core business. Additional detail regarding the potential merits of a borrow-to-fund strategy can be found here.

Looking Ahead

Looking ahead to future plan years, per the November Pension Finance Update, PPA funding relief will gradually sunset and this will generally lead to increased contributions from plan sponsors. Plan sponsors may wish to use these contributions to reduce the plan’s overall liability through use of a Pension Risk Transfer.

In 2020, the PBGC Flat-Rate Premium, Variable-Rate Premium, and Variable-Rate Premium Cap have each increased. Per the 2020 PBGC Premium Burden Report, PBGC premiums remain a major threat to even the most carefully managed pension plans. Continued attention to premiums should be a central part of viable pension management for the foreseeable future. Through use of a Pension Risk Transfer, plan sponsors can eliminate or significantly reduce future PBGC premiums.

In October 2019, the Society of Actuaries published (1) a new Mortality Improvement Scale MP-2019 and (2) new base Pri-2012 Mortality Tables. Both the MP-2019 and Pri-2012 will generally reduce defined benefit plan liability valuations marginally.

Have a pension risk transfer need but not sure where to start? See our article, What to Look for in an Annuity Search Firm.

*October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed 2 hypothetical annuity plans which have been valued using the latest mortality tables. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual 2019 and 2020 PRT market activity and the corresponding impact on pension plans.