Current legislative outlook – beyond SECURE – the next round of (possible) bipartisan retirement legislation

The Setting Every Community Up for Retirement Enhancement (SECURE) Act – which includes (among other things) a defined contribution plan annuity fiduciary safe harbor, closed group relief, authorization of DC Open multiple employer plans (MEPs), mandatory lifetime income disclosure, and mandatory coverage of long-term part-time employees – remains stalled in the Senate. There is broad bipartisan support for the bill, which passed the House by an overwhelming majority in May. While moving it under Senate rules over the objections of certain Senators has thus far proved difficult-to-impossible, there remains a possibility that SECURE will pass this year, perhaps as part of a year-end budget deal, or as part of multiemployer plan relief.

Meanwhile, key policymakers are looking beyond, to additional legislation that did not make it into the SECURE Act. In this article we review key proposals by Representative Neal (D-MA), Chairman of the House Ways and Means Committee, Senators Portman (R-OH) and Cardin (D-MD), and Senators Grassley (R-IA) and Alexander (R-TN) that are not part of SECURE but are being actively considered as part of the next round of retirement legislation. These include Congressman Neal’s 2017 Automatic Retirement Plan Act (H.R. 4523) and Retirement Plan Simplification and Enhancement Act (H.R. 4524), the Portman-Cardin 2019 Retirement Security and Savings Act, and proposals to address the multiemployer plan financial crisis.

New Automatic Enrollment Safe Harbor (Neal and Portman-Cardin)

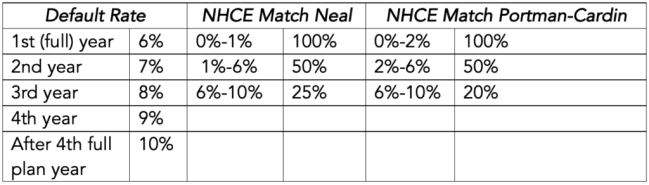

Both the Neal and Portman-Cardin proposals would add a new 401(k) actual deferral percentage (ADP) testing auto-enrollment/escalation safe harbor. The chart below sets forth the default rates and the (differing) matching contribution requirements under the two proposals.

This proposal has been under consideration for some time and has broad bipartisan support. The biggest plan sponsor concern has been that the required matching contributions – which must be vested when made – are still relatively high.

Student loan repayments treated as elective deferrals for purposes of matching contributions (Portman-Cardin only)

The Portman-Cardin proposal would generally allow a plan to treat a student loan repayment (subject to certain limits) as “match-able” pursuant to rules similar to those applicable to “regular” 401(k) employee contributions (aka “elective deferrals”). The loan repayment itself, however, would not be considered an employee contribution (e.g., for purposes of ADP testing).

This proposal would solve one problem with current 401(k) plan/student loan rules. There remains a question for some sponsors, however, as to whether this sort of program may – without further relief – undermine ADP testing.

Expansion of the Saver’s Credit (Portman-Cardin only)

The Saver’s Credit currently provides for a non-refundable tax credit equal to up to 50 percent of the first $2,000 of contributions by certain low-income individuals to a 401(k) plan, IRA or certain other retirement programs. Portman-Cardin would increase the income limits applicable to the Saver’s Credit; make the credit refundable; and require that, instead of being credited directly to the taxpayer, the credit would be paid to a qualified plan or other “applicable retirement plan.” Efforts to expand the Saver’s Credit date back to at least the beginning of the Obama Administration.

Use of “blended” benchmarks (Neal and Portman-Cardin)

Both the Neal and Portman-Cardin proposals would instruct DOL to produce regulations allowing benchmarking of funds (e.g., for required DC participant disclosure) that include multiple asset classes (e.g., balanced funds and target date funds) based on a benchmark that is a blend of different broad-based securities market indices.

Other proposals –

Both the Neal and Portman-Cardin proposals would instruct the agencies to simplify and consolidate disclosure, and they both include provisions allowing a sponsor to pay “de minimis financial incentives” (e.g., a non-plan cash bonus) to participants for contributing to a 401(k) plan.

In addition, Portman-Cardin would:

Allow employees to elect to pay (or not pay) for retirement planning services without triggering “constructive receipt” of income.

Apply the minimum participation rule (which currently requires that a plan cover at least 50 employees or 40% of employees in the employer’s controlled group) separately to “bona fide separate subsidiaries or divisions.”

Instruct Treasury to modify 401(k) rules to facilitate the use of base pay or rate of pay in determining contributions or benefits.

Eliminate ongoing plan disclosures to unenrolled DC plan participants (e.g., a “participant” who has elected not to make contributions to and has no balance in a 401(k) plan).

Extend through 2029 the period during which certain surplus DB assets may be transferred to an Internal Revenue Code section 401(h) retiree medical account under IRC section 420.

More controversial

The foregoing proposals generally have broad bipartisan support. There are (at least) two other major initiatives that have significant support but are nevertheless controversial –

Neal Automatic Retirement Plan proposal

Under Representative Neal’s Automatic Retirement Plan Act proposal, all employers with more than 10 employees would generally be required to maintain an “automatic contribution plan.” Generalizing, employers that do not already have a 401(k) plan would at least have to adopt a “deferral only” plan, subject to a number of rules. The bill would also provide for a “credit” (in effect, a tax-financed matching contribution) of 50% of the first $1,000 of “qualified savings contributions” made by certain low-paid individuals.

The bill provides that an employer that maintains an automatic contribution plan is generally not subject to state payroll deduction programs (e.g., state auto-IRA programs). There is, however, a carve-out for pre-existing state laws.

Multiemployer plan relief

The PBGC’s 2019 Annual Report shows a record $65.2 billion deficit for the multiemployer plan insurance system and states that there is a “very high likelihood of insolvency during FY 2025.” The financial problem at PBGC reflects a broader financial crisis in the multiemployer plan system itself.

There is bipartisan agreement in Congress that something must be done to address the multiemployer plan financial crisis, just no agreement on what.

Neal proposal: Representative Neal’s Rehabilitation for Multiemployer Pensions Act (known as the “Butch Lewis Act”) passed the House in July, with some bipartisan support (the vote was 264-169). Neal’s bill, very generally, would provide financial support (e.g., federally subsidized loans) to struggling multiemployer plans.

Grassley-Alexander proposal: On November 20, 2019, Senators Grassley (R-IA) and Alexander (R-TN) released a White Paper and Technical Discussion on their ��“Multiemployer Pension Recapitalization and Reform Plan,” which would among other things:

Increase multiemployer plan premiums and introduce a variable-rate premium tied to funded status and a new “stakeholder co-payment” assessed on employers and unions participating in a plan and on retirees (on a sliding-scale based on the plan’s funded status).

Expand PBGC’s authority to partition struggling plans.

Increase the PBGC multiemployer plan insurance guarantee.

Transfer “a limited amount of federal taxpayer funds to PBGC.”

Reform multiemployer plan liability valuation rules.

Simplify multiemployer plan withdrawal liability rules by requiring measurement using the same actuarial assumptions used for plan funding purposes. This could serve to relieve the current controversy over selection of assumptions in cases of partial or complete withdrawal.

Reform plan governance.

Provide an option to establish a new hybrid pension plan “that pools employer contributions for investing, but only provides benefits to participants based on the contributions and any associated gains on their investment.”

* * *

We will continue to follow these issues.