December 2023 Annuity Purchase Update

For the first time in history, the majority of insurance carriers hit capacity in the fourth quarter – withdrawing from bids that they originally committed to. It is crucial to enter the marketplace early to avoid this risk.

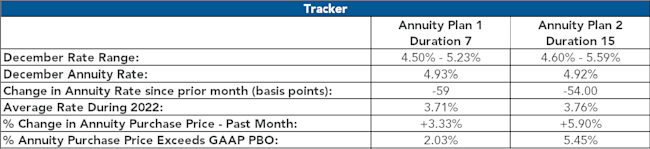

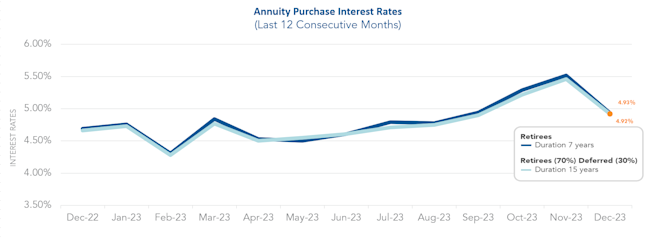

Average annuity purchase interest dropped this month, with the average duration 7 rate at 4.93% and average duration 15 rate at 4.92%.

In the fourth quarter, insurance carriers hit capacity constraints leading them to withdraw from transactions for the remainder of the year. It is crucial for plan sponsors to engage a Pension Risk Transfer specialist at the beginning of the year to transact as soon as possible.

High stock market returns are offsetting the impact of falling interest rates. Month-to-month cost volatility has persisted over the past year, and it has been the case that entrance into the PRT market early in the year can help plan sponsors.

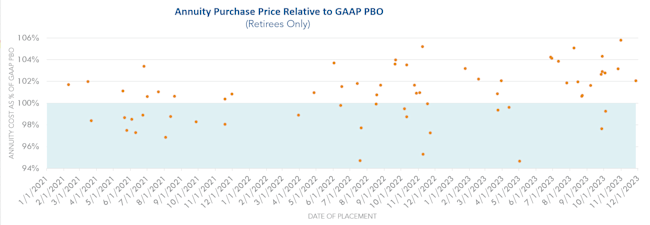

Annuity purchase cost for retiree placements brokered by October Three Annuity Services has on average been 101.02% of the pension accounting value (GAAP PBO).

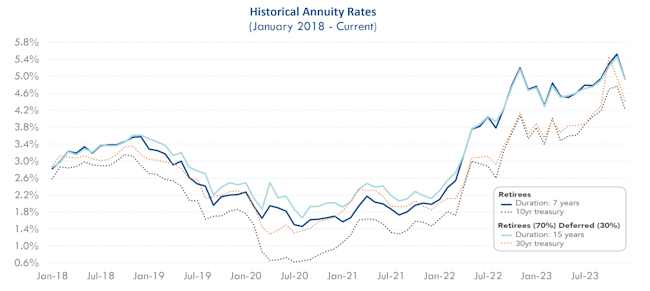

The Pension Risk Transfer market is on track to have yet another record year. The strong momentum in the first half of 2023 carried into the second half. In 2023, we observed a consistent rise in rates, but last month we recorded more than a 50-basis point decrease in the average annuity purchase interest rates. As mentioned in the Pension Finance Update, interest rates declined, but higher stock markets improved asset values. The average duration 7 annuity purchase interest rate dropped to 4.93% and the average duration 15 annuity purchase interest rate declined to 4.92%. Although rates declined, they remain above average for 2023. Although current market conditions aren’t as enticing, insurance carriers remain very busy and expressed they no longer have capacity to take on additional business in 2023. Insurance carriers have already begun preparing for 2024 so we recommend plan sponsors connect with an annuity search firm sooner rather than later to achieve their de-risking goals.

Annuity purchase interest rates and treasury yields continue to demonstrate variations over time. In 2023, we have observed an overall upward trend in both annuity purchase interest rates and treasury rates but this last month we recorded a sharp decline. Since last month, the spread between the 10-year treasury rate and 30-year treasury rate narrowed, placing the two rates 18 basis points apart. Since the beginning of the month, both the 10-year and 30-year treasury rates have continued to decrease.

Top 3 ways PRT is lowering plan costs

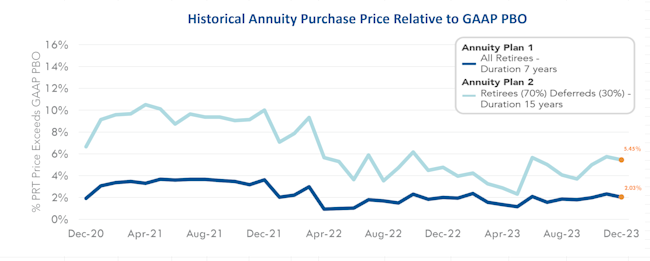

The graph below shows the spread between annuity purchase price above GAAP projected benefit obligation (PBO). We refer to GAAP PBO and accounting book value interchangeably. In December, we noted the spread between annuity purchase price above GAAP PBO for both plans narrowed. For Annuity Plan 1, the spread decreased to 2.03% and Annuity Plan 2 dropped to 5.45%. The current spreads for both hypothetical plans are lower than historical averages, but high with respect to the 2023 average. A decrease in annuity purchase rates inversely increases annuity purchase prices relative to accounting book value. Please note that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs.

The graph below represents the annuity purchase price relative to GAAP projected benefit obligation (PBO) of the retiree cases placed by October Three Annuity Services since 2021. Year to date, annuity purchase cost for retirees was on average 102.38% of GAAP PBO. Since 2021, the average purchase cost was 101.02% of GAAP PBO. We expect the robust activity of 2023 to spill into 2024. Insurance carriers have already expressed reaching capacity for 2023, so we look forward to 2024 for more favorable market conditions. For optimal competition and increased participation, it is wise for plan sponsors to collaborate with an annuity search sooner rather than later.

Additional Risk Mitigation Strategies to Consider

Annuity Purchase interest rates have displayed a consistent upward trend this past year, but we witnessed a sharp decline in rates this past month. The annuity purchase price increased for both hypothetical plans. For Annuity Plan 1 by 3.33% and for Annuity Plan 2 by 5.90%. Annuity Purchase interest rates in 2023 have been less volatile than 2022 but activity this last month has shown significant fluctuations. Although the graph below shows a month-to-month fluctuation, annuity purchase interest rates are market dependent and actually fluctuate daily. To hedge against this short-term volatility, a plan sponsor terminating their pension plan could settle the retiree portion of their liability to "lock in" favorable rates.

This year is on track to be a record year for the Pension Risk Transfer Market. Although pension funding took a hit the last few months, plan sponsors have taken strides to de-risk their pension plans. The Pension Risk Transfer Market will continue to gain more traction. Given the robust market activity, purchasing annuities in 2023 is unattainable, but plan sponsors should consider connecting with an annuity search firm and getting data in good order sooner rather than later to achieve their de-risking goals in 2024. Annuity purchases do not need to occur on an all-or-nothing basis so to capitalize on favorable market conditions, a plan sponsor should consider purchasing annuities for a subset of the retiree population with small benefits. PBGC premiums for participants do not vary based on the size of the participant's benefit. Purchasing annuities for a subset of the population would guarantee PBGC savings.