July 2022 Annuity Purchase Update

Executive Summary

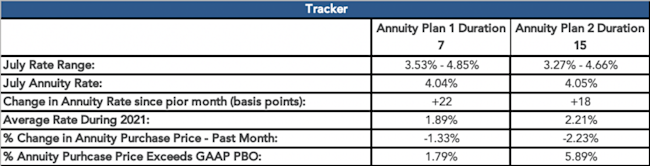

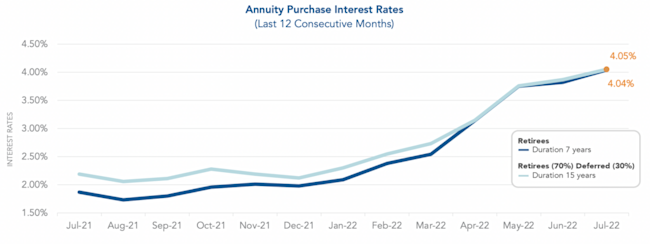

• The average Annuity Purchase Interest rates jumped again this past month, with the average duration 7 rate at 4.04% and average duration 15 at 4.05%. **

• Despite low stock market returns, average annuity rates thus far in 2022 are substantially higher than 2021 average annuity rates.

• Since January 2022, the cost for Annuity Plan 1* and Annuity Plan 2* has reduced by 16% and 27%, respectively.

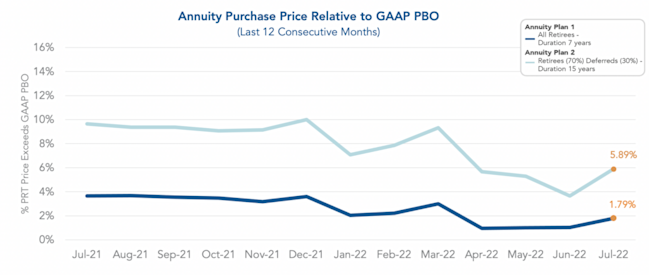

• Although the spread widened this past month, annuity purchase costs relative to pension accounting value (GAAP PBO) is well below our historical averages making Pension Risk Transfer solutions even more appealing.

• Average Annuity rates have increased over 170 basis points, and Treasury rates have increased over 130 basis points since the beginning of the year, suggesting an opportune time for Plan Sponsors to consider implementing a pension risk transfer strategy.

** These rates are indicitave as of July 1, 2022.

Narrative

As mentioned in the Pension Finance update, stock markets continued to decline, as June marked the worst month of the year for plan funding status, although the year to date impact is not too significant. Inversely, average annuity purchase rates as of July 1, 2022 are the highest we have ever observed with the average annuity 7 rate at 4.04% and average duration 15 rate at 4.05%. This is the first we have seen these rates surpass 4%. Although rates have declined since, average annuity rates have nearly doubled since the beginning of the year. Annuity purchase interest rates and market activity have been steadily increasing. The market rush has insurance carriers nearing capacity. It is crucial for plan sponsors to enter the market place sooner rather than later to exploit favorable pricing. To take advantage of aggressive pricing, plan sponsors should consider preparing for an annuity purchase.

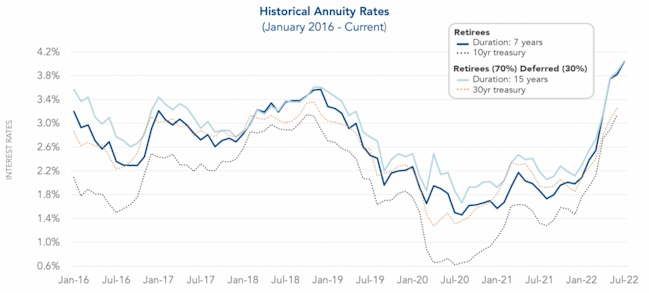

As seen below, annuity purchase interest rates and treasury yield rates vary over time resulting in different degrees of peaks and valleys. The 10 year treasury rates correlate with the duration 7 annuity purchase interest rates. Similarly, the 30 year treasury rates correlate with the duration 15 annuity purchase interest rates. The treasury yield rates have consistently grown year to date and appear to have an upward tend. The 10 year treasury rate sky rocketed roughly 138 basis points and the 30 year treasury rose about 115 basis points since January 2022. Given the rapid increase in rates and surge in market activity, a timely entry into the market place is critical for plan sponsors to receive favorable pricing. Implementing a Pension Risk Transfer strategy can help a plan sponsor fulfill organizational goals, including reducing volatility in financial disclosures due to volatile interest rates.

Top 3 ways PRT is lowering plan costs

The graph below displays the difference between annuity purchase price above GAAP projected benefit obligation (PBO). We refer to GAAP PBO and accounting book value interchangeably. In July 2022, the spread for Annuity Plan 1 slightly increased to 1.79% and 5.89% for Annuity Plan 2. Although it widened, the spread is still substantially lower than the historical averages. An increase in annuity purchase rates generally lowers annuity purchase prices relative to accounting book value. Please note, that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs. Future overhead costs would narrow the spread, though the extent is plan specific.

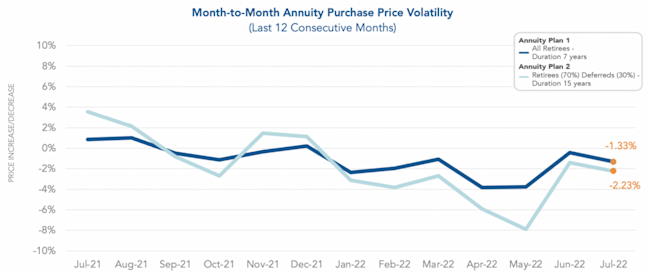

Annuity purchase cost can alter from month to month. Although the market is volatile, we have seen a general downward trend in cost over the last 12 months. Annuity Purchase costs have consistently declined from month to month since January 2022. Since last month, The purchase price for Annuity Plan 1 decreased 1.33% and Annuity Plan 2 dropped 2.23%. An early entrance to the insurance market is a vital component of the planning stage because of the consistent short-term volatility of annuity pricing. By connecting with an annuity search firm early on, plan sponsors can capitalize on favorable fluctuations in a volatile market.

Additional Risk Mitigation Strategies to Consider

Annuity purchases for plan sponsors do not need to occur on an all-or-nothing basis. Many plan sponsors can benefit by purchasing annuities, even for a subset of plan participants. This is especially true for retirees with small benefit amounts. Plan sponsors pay PBGC premiums for participants that do not vary based on the size of the participant’s benefit. For retirees with small benefit amounts, the PBGC premium overhead burden is substantial and can be eliminated through an annuity purchase.

Have a pension risk transfer need but not sure where to start? See our article, What to Look for in An Annuity Search Firm.

October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long-established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed two hypothetical annuity plans, which have been valued using the latest mortality tables and mortality improvement scales. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 includes 70% retirees and 30% deferred and has a liability duration of 15 years. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual PRT market activity and the corresponding impact on pension plans.