Markets 2020 – effect on ERISA minimum funding requirements – March 24, 2020, update

As we discussed in our introduction to these issues, the current situation is (to state the obvious) very volatile. Since our last article (posted March 16, 2020), corporate bond yields gyrated wildly, increasing by more than 100 basis points before pulling back yesterday, to levels above those at December 2019. Assets, on the other hand, remain dramatically lower on the year.

For the moment we are going to provide updates to the key data points we identified in our March 16 article. For details on methodology, etc., please refer to that article.

Bottom line: The key conclusions in our earlier article have not changed. Funding requirements for 2020 for a calendar year plan were locked in as of January 1, 2020. 2020 asset declines may affect minimum funding as early as 2021. Interest rate declines won’t show up in minimum funding numbers until 2023. If they persist.

What has changed? Two things: (1) On March 16, we were projecting that interest rate declines meant that sponsors would have to live with lower HATFA valuation interest rates for the foreseeable future – past 2030. If current (March 23, 2020) rates persist, we’re now projecting that (higher) market rates will take sponsors out of the HATFA regime beginning as early as 2025 or 2026. And (2) asset declines – which have a more immediate effect on plan funding – have worsened, with the result that more plans will begin to have asset-driven minimum funding issues beginning perhaps as early as 2021.

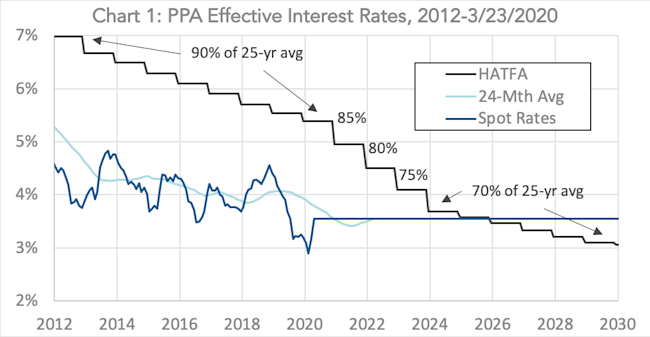

Valuation interest rates for ERISA minimum funding

As this chart shows, market (spot) interest rates are (at current very volatile rates) projected to be higher than HATFA rates beginning around 2026. That’s worse than the situation at the beginning of 2019, when market interest rates were projected to be higher than HATFA rates beginning as early as 2023. This change will result in lower asset valuation rates (and higher valuations) beginning in 2023. But it is better than the situation a week ago, when lower HATFA valuation rates were projected to last for the foreseeable future. Now we’re projecting that market rates will exceed HATFA rates by 2025 or 2026.

Datapoint #1: Liability valuations will go up beginning in 2023.

Asset performance

Equities are down 30% on the year. Treasury bonds have done well, but corporates have lost ground. Each plan’s asset performance will depend on its portfolio strategy, but it is likely that many plans will sustain significant asset losses this year, if current conditions persist.

If a plan sustains significant 2020 asset losses, it may see an increase in ERISA minimum funding requirements before 2023 (that is, before declining interest rates begin to affect funding), but the situation is somewhat complicated.

Contributions for 2020 are based on asset values determined as of January 1, 2020, so 2020 asset losses will have no effect on 2020 funding. They may, however, increase a plan’s funding shortfall and minimum funding requirements for 2021. That shortfall will generally have to be paid for beginning in 2022, starting with _2022_quarterlies and ending with the September 2022 residual contribution for 2021.

Datapoint #2: Asset declines may require additional contributions beginning as early as 2022 (April 15, 2022 for calendar year plans).

Funding Regime 2

More problematic for some plans will be what we have called PPA’s “Funding Regime 2” – a number of requirements and restrictions (e.g., on the payment of lump sums) that are triggered when plan funding falls below 80%.

If the sponsor wants to avoid Regime 2 restrictions for 2021 (e.g., to implement a 2021 lump sum de-risking program), it may have to make significant contributions in 2021.

Datapoint #3: Sponsors that want (or need) to keep plan funding above the 80% Regime 2 trigger may have to make contributions by March 31, 2021.

* * *

We will be updating these numbers regularly.