Pension Finance Update September 2024

Pension finances experienced a slight decline in September, as lower interest rates pushed up liabilities.

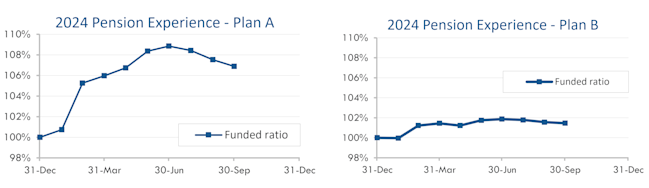

Pension finances experienced a slight decline in September, as lower interest rates pushed up liabilities. Both model plans we track[1] lost ground last month: Plan A lost less than 1% but remains up almost 7% this year through September, while Plan B lost a fraction of 1% but remains up more than 1% through the first three quarters of 2024:

[1] Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a largely retired plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long-duration bonds. We assume overhead expenses of 1% of plan assets per year, and we assume the plans are 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities.

Assets

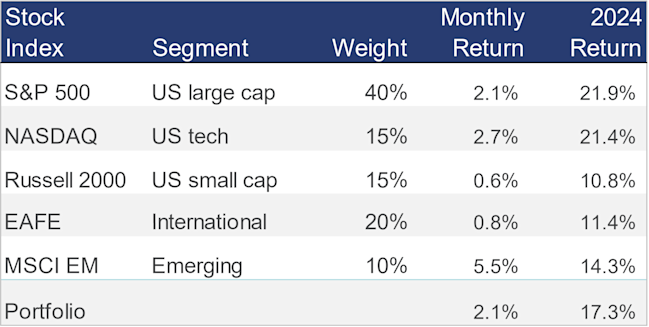

Stocks were up modestly during September. A diversified stock portfolio gained more than 2% last month and is now up 17% for the year through September, with US large cap and tech stocks leading the way:

Treasury rates fell 0.1% during September while credit spreads again narrowed to historic levels. As a result, bonds gained 2% during September, ending the month up 2% to 5% for the year, with long duration bonds performing worst.

Overall, our traditional 60/40 portfolio gained almost 2% last month and is now up 11% for the year, while the conservative 20/80 portfolio gained 2% last month, ending September up 6% for the year.

Liabilities

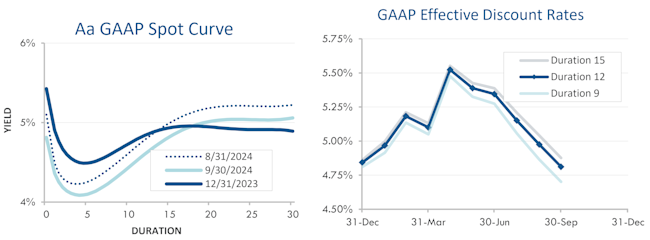

Pension liabilities (for funding, accounting, and de-risking purposes) are driven by market interest rates. The first graph below compares our Aa GAAP spot yield curve at December 31, 2023 and September 30, 2024 (along with the movement in the curve last month). The second graph below shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration during 2024:

Corporate bond yields fell 0.15% in September and are now slightly below rates at the end of 2023. As a result, pension liabilities rose 2%-3% last month and are now up 3%-5% for the year through September, with long duration plans enjoying the best experience.

Summary

Pension sponsors enjoyed consistently good experience during the first half of 2024, but the third quarter saw plans give back some of these gains as interest rates moved lower. Still, through September, 2024 continues to look like another positive year for pension finances. The graphs below show the movement of assets and liabilities during the first three quarters of 2024:

Looking Ahead

Sustained higher interest rates since late 2022 have diminished the impact of pension funding relief that has been in place since 2012. Underfunded plans are likely to see higher required contributions in the next year or two.

Discount rates for corporate financial reporting moved lower last month. We expect most pension sponsors will use effective discount rates in the 4.7%-5.0% range to measure pension liabilities on their balance sheets right now.

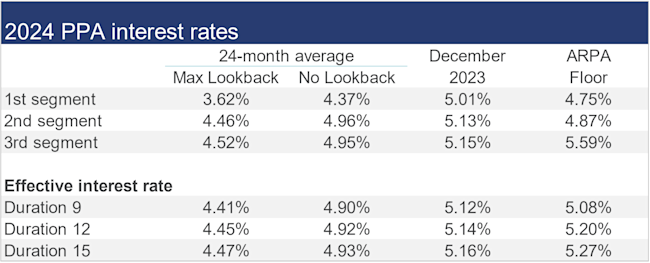

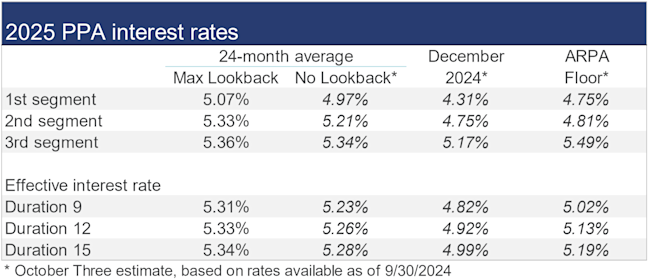

The table below summarizes rates that calendar-year plan sponsors are required to use for IRS funding purposes for 2024, along with estimates for 2025. Pre-relief, both 24-month averages and December ‘spot’ rates, are also included.