How Much Does My 401(k) Plan Save Me In Taxes?

There’s a superficial answer to this question — just multiply your marginal tax rate times the amount of this year’s benefit. So, if you are getting a benefit that is worth, say, $10,000, and your tax rate is 39.6%, then your tax saving $3,960. That is the wrong answer – in what follows we are going to show you how to figure out the right answer.

A tax deferral not a write-off

The way tax benefits for retirement savings work, you get a deduction when the money goes in, earnings on that money are not taxed, and then you pay taxes (at ordinary income tax rates) when it is distributed. So, in effect, it’s a tax deferral system — you get a deduction up front, but pay taxes at the back end.

When you do the math, you discover that the two most important tax benefits for retirement savings are the non-taxation of trust earnings and (where this is relevant) any shifting of income from a high tax rate year (the year of contribution) to a lower tax rate year (the year of distribution). To figure out how much taxes you are saving, you then have to compare what you’re getting from the plan with what you would have gotten if you saved outside the plan. That’s your tax benefit.

Retirement tax benefit math

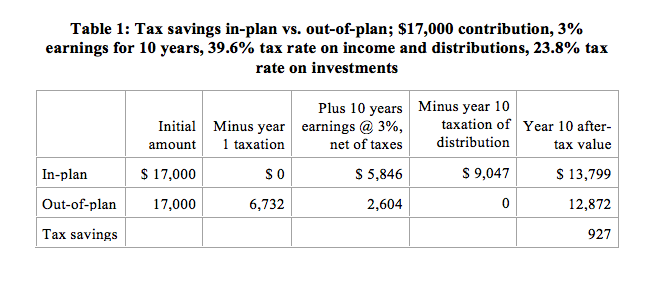

Let’s walk through that calculation for a sample participant. We have to begin with some assumptions. Let’s say this participant is contributing $17,000 to the plan this year. Let’s assume (as we have done in prior articles) that she will earn 3% interest on that money and will leave it in the plan for 10 years.

We’re going to assume the participant is taxed at the highest rates (both income tax and capital gains). Thus, she pays a 39.6% ordinary income tax rate, a 20% capital gains rate, and, for investment earnings outside the plan, the new 3.8% Medicare tax on net investment income. Finally, we’ll assume she is taxed at the same rate in the year of contribution and the year of distribution.

Here’s what this participant will have after 10 years if she saves the $17,000 in the plan vs. saving it outside the plan.

So the total tax savings after 10 years is $927 (note — that isn’t present value, it’s the value after 10 years).

Key factors: how long the money is in the plan and rate of return

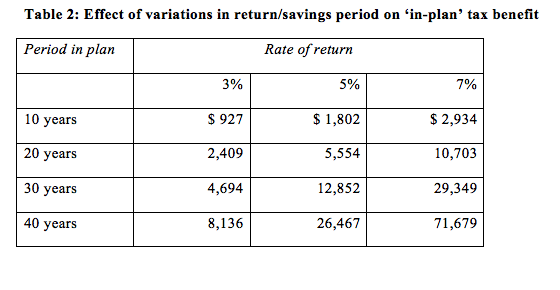

This value is significantly affected by two factors – how long you leave your money in the plan and what your earnings rate is. The following table shows the impact of changing those assumptions.

As you can see, leaving the plan in longer and increasing the rate of return both significantly increase the value of the tax benefit. It is worth emphasizing that the greater value associated with longer horizons does not merely reflect ‘the time value of money’ – once we see that the real value of the 401(k) plan lies in the ability to defer taxation of investment earnings, it is clear that the longer one can defer this taxation, the more valuable the tax benefit.

Shifting income to a lower tax rate year

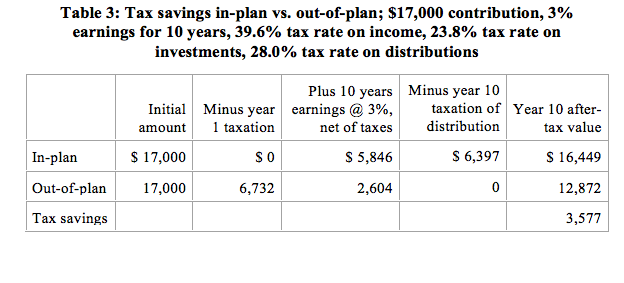

Finally, the value of the benefit increases significantly if the tax rate on distribution is lower than the tax rate on contribution. In this case, you are in effect shifting income from a high tax year to a lower tax year. Here’s our first table again, but this time assuming that the in-plan savings are taxed at 28% on distribution, rather than 39.6%.

If the participant is in the 28% tax bracket (instead of the 39.6% bracket) when the money is disbursed from the 401(k) plan, the value of the tax benefit is almost four times greater ($3,577 versus $927) in this example.

Bottom line

The retirement tax benefit has significant value. The key factors in driving that value are: (1) how long you leave your money in the plan; (2) how much you earn while your money is in the plan; and (3) whether your tax rate on distribution is lower than your rate was when you made your contribution.