IRS Private Letter Ruling OKs 401(k)/student loan repayment program

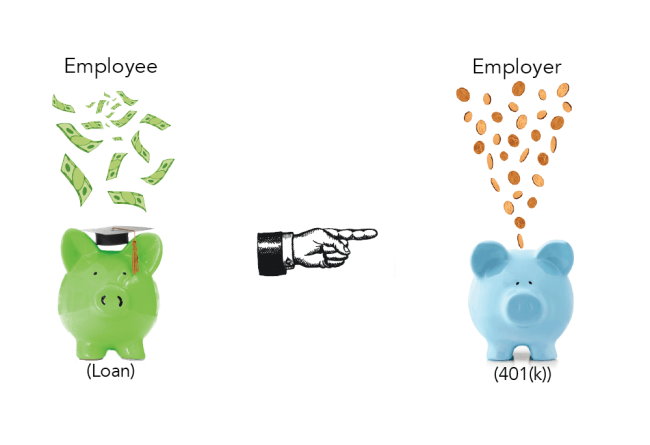

On August 18, 2018, the Internal Revenue Service released Private Letter Ruling (PLR) 201833012, concluding that a 401(k) plan that provided for “an employer non-elective contribution on behalf of an employee conditioned on that employee making student loan re-payments” did not violate Internal Revenue Code section 401(k) prohibitions on conditioning a benefit on an employee making elective contributions. The new IRS guidance, while it is only a PLR (and therefore legally only applicable to the taxpayer that requested the ruling), provides a compliance roadmap for at least one type of 401(k)/student loan repayment program.In this article, we begin with a discussion of the regulatory issue. We then discuss the plan design considered in the PLR and IRS’s analysis of it. We conclude with a brief consideration of other issues a sponsor might want to consider with respect to one of these programs.

On August 18, 2018, the Internal Revenue Service released Private Letter Ruling (PLR) 201833012, concluding that a 401(k) plan that provided for “an employer non-elective contribution on behalf of an employee conditioned on that employee making student loan re-payments” did not violate Internal Revenue Code section 401(k) prohibitions on conditioning a benefit on an employee making elective contributions. The new IRS guidance, while it is only a PLR (and therefore legally only applicable to the taxpayer that requested the ruling), provides a compliance roadmap for at least one type of 401(k)/student loan repayment program.

In this article, we begin with a discussion of the regulatory issue. We then discuss the plan design considered in the PLR and IRS’s analysis of it. We conclude with a brief consideration of other issues a sponsor might want to consider with respect to one of these programs.

Prohibition on conditioning a benefit on 401(k) contributions

Sponsors considering implementing a 401(k)/student loan repayment program have expressed concern about the following prohibition in Internal Revenue Code section 401(k):

A cash or deferred arrangement of any employer shall not be treated as a qualified cash or deferred arrangement if any other benefit is conditioned (directly or indirectly) on the employee electing to have the employer make or not make contributions under the arrangement in lieu of receiving cash. The preceding sentence shall not apply to any matching contribution (as defined in section 401(m)) made by reason of such an election.

This rule is generally understood to prohibit the use of an “outside the plan” benefit (e.g., additional vacation time) as an incentive for a participant to make “inside the plan” 401(k) elective contributions. Thus, a plain reading of this rule would prevent, e.g., an employer conditioning repayment (by the employer) of a student loan on the employee making an elective contribution to the 401(k) plan.

The proposed student loan repayment program and IRS’s analysis

The taxpayer requesting the PLR, in effect, reversed that design, proposing the use of an “inside the plan” benefit (a 5% contribution on the employee’s behalf) as an incentive for an “outside the plan” contribution – student loan repayment by the participant. Quoting the PLR:

Under the program, if an employee makes a student loan repayment during a pay period equal to at least 2% of the employee’s eligible compensation for the pay period, then Taxpayer [the plan sponsor] will make [a student loan repayment] non-elective contribution as soon as practicable after the end of the year equal to 5% of the employee’s eligible compensation for that pay period.

The IRS concluded that this design did not violate the (above-noted) 401(k) prohibition on conditioning “any other benefit” on elective 401(k) contributions: “In the present case, [the employer] non-elective contributions … are conditioned on whether an employee makes a student loan repayment … and are not conditioned (directly or indirectly) on the employee making elective contributions under a cash or deferred arrangement.”

The program would be voluntary. And it would involve a number of complexities. Participants in it could still make elective 401(k) contributions, but their elective 401(k) contributions would not be eligible for an (additional) 5% match. On the other hand, if a participant did not make a student loan repayment of at least 2% of pay (and therefore did not get the 5% student loan repayment non-elective contribution) but did make a 401(k) contribution of at least 2% of pay, then the sponsor _would_make a matching contribution of 5% of pay. Thus, a participant could get a 5% non-elective contribution with respect to a student loan repayment or a 5% match with respect to an elective 401(k) contribution, but not both.

These elements of the program appear to be critical to compliance with 401(k) rules. Quoting the PLR: “because an employee who makes student loan repayments and thereby receives SLR non-elective contributions is still permitted to make elective contributions, the [student loan repayment] non-elective contribution is not conditioned (directly or indirectly) on the employee electing to have the employer make or not make contributions under the arrangement in lieu of receiving cash.”

The student loan repayment non-elective contributions are subject to the same vesting schedule as regular matching contributions and are subject to “all applicable plan qualification requirements, including, but not limited to, eligibility, vesting, and distribution rules, contribution limits, and coverage and nondiscrimination testing.” They are _not_treated as matching contributions for purposes of nondiscrimination testing under Internal Revenue Code section 401(m).

The IRS disclaimed any opinion on the federal tax treatment of any other aspect of the transaction.

Evaluation

Many sponsors and participants have expressed interest in this sort of program. For many younger participants, paying down student debt may be a higher priority (and a more valuable “benefit”) than saving for retirement.

Nevertheless, as the complexity of the transaction considered by IRS in the PLR indicates, a 401(k)/student loan repayment program presents a number of issues that a sponsor will want to consider, very much with the assistance of tax counsel. To note a few:

Participant student loan repayments will not count toward actual deferral percentage (ADP) testing and the related employer non-elective contributions will not count towards actual contribution percentage (ACP) testing. If passing these tests is a challenge, adopting a 401(k)/student loan repayment program may present a problem.

The right to receive a non-elective contribution as a result of making a student loan repayment must be both currently and effectively available on a nondiscriminatory basis. While we would expect that this will not be problematic for the typical employer, there may be situations where most employees who are eligible for the program would be highly compensated employees.

In the opposite case, where the employees participating in the student loan repayment program are generally non-highly compensated, the fact that they are making student loan repayments rather than 401(k) elective contributions may negatively affect ADP or ACP testing results, reducing the amount that could be contributed by/for highly compensated employees.

Unlike regular 401(k) contributions, student loan repayments (e.g., in the PLR, the 2% of pay that is used by the participant to pay down a student loan) would generally have to be made on an after-tax basis. As a result of this tax treatment, student loan repayments will, in effect, “cost more” (to the participant) than regular 401(k) contributions.

* * *

We will continue to follow this issue.