Pension Finance Update May 2023

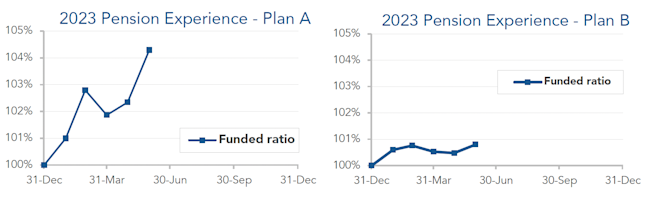

Higher interest rates gave pension finances a boost in May. Both model plans we track gained ground last month: our traditional Plan A gained 2% last month and is now up 4% for the year, while the more conservative Plan B edged up fractionally during May and is up almost 1% through the first five months of 2023.

Higher interest rates gave pension finances a boost in May. Both model plans we track (1) gained ground last month: our traditional Plan A gained 2% last month and is now up 4% for the year, while the more conservative Plan B edged up fractionally during May and is up almost 1% through the first five months of 2023:

Assets

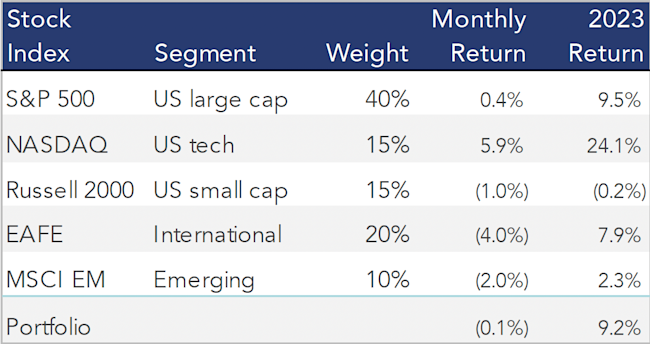

Both during May and throughout 2023 so far, technology stocks (NASDAQ) have soared, while other flavors of equities have ranged from flat to good. A diversified stock portfolio was flat during May and remains up 9% through the first five months of 2023:

Interest rates moved higher last month. As a result, bonds lost 2%-3%. For the year through May, a diversified bond portfolio has earned 2%-4%, with long duration bonds performing best.

Overall, both plans we track lost ground last month: Plan A lost 1% but remains up 6% for the year, while Plan B slipped almost 2% but is still ahead 3% through the first five months of 2023.

1 Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a largely retired plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long-duration bonds. We assume overhead expenses of 1% of plan assets per year, and we assume the plans are 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities

Liabilities

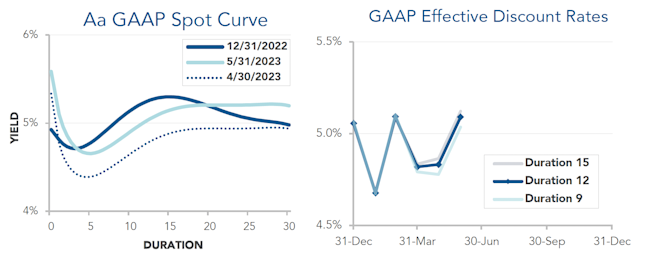

Pension liabilities (for funding, accounting, and de-risking purposes) are driven by market interest rates. The first graph below compares our Aa GAAP spot yield curve at December 31, 2022 and May 31, 2023, and it also shows the movement in the curve last month. The second graph below shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration so far this year:

Corporate bond yields jumped 25 basis points in May. As a result, pension liabilities fell 2%-3% during the month and are now up 2%-4% for the year through May.

Summary

Interest rates moved back above 5% last month, close to levels seen at the end of 2022. Meanwhile, tech stocks have led an increase in stock portfolios this year. If it holds, this trend will mark the third consecutive year of capital market tailwinds for pension sponsors. The graphs below show the movement of assets and liabilities during the first five months of 2023:

Looking Ahead

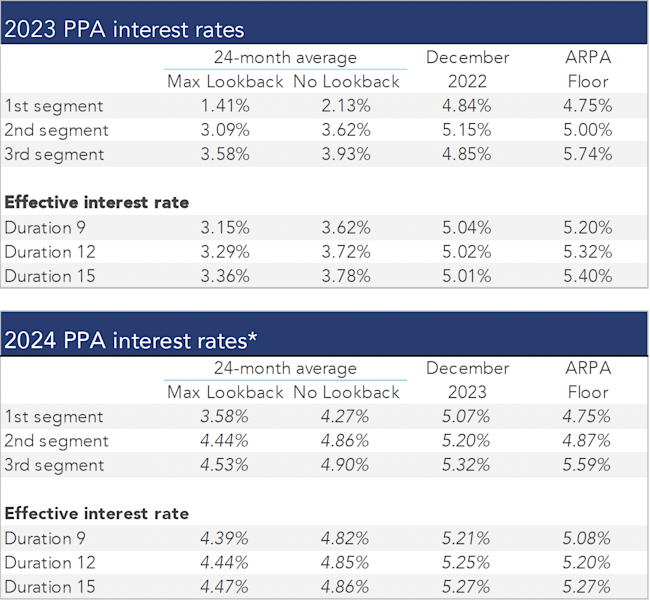

Pension funding relief was signed into law during March of 2021, and additional relief was provided by November 2021 legislation. The new laws substantially relaxed funding requirements over the next several years, but the increase in rates seen in the past year has eroded the impact of relief.

Discount rates moved higher last month. We expect most pension sponsors will use effective discount rates in the 4.9%-5.2% range to measure pension liabilities right now.

The table below summarizes rates that plan sponsors are required to use for IRS funding purposes for 2023, along with estimates for 2024. Pre-relief, both 24-month averages and December ‘spot’ rates, which are still required for some calculations, such as PBGC premiums, are also included.

* October Three estimate, based on rates available as of 5/31/2023