Annuity Purchase Update: May 2021 Interest Rates

Despite the persistence of the pandemic, it is clear that the outlook for plan sponsors is currently trending positively. Equity markets are strong and interest rates are rising. This is leading to improved plan funding statuses and lower annuity purchase prices.

May Highlights

+ Plan funding status grew slightly

Stock markets rose

Interest rates dropped

Most pension plans with an asset portfolio of 60% equities and 40% fixed income improved their funding status around 12% year-to-date.

+ Annuity purchase costs rose

Annuity purchase interest rates decreased

Insurance company competition remains high

Annuity purchase cost for retirees has frequently been equal to the pension accounting value (GAAP PBO)

Executive Summary

The American Rescue Plan Act of 2021 (ARPA) was passed and will increase funding relief for plan sponsors. However, if plan sponsors continue to contribute only their required minimum contributions, PBGC premiums will increase substantially.

PBGC premiums have increased in 2021. This raises plan maintenance costs and can make Pension Risk Transfer solutions even more appealing.

An annuity purchase for even a subset of plan participants would allow for plan sponsors to lock in the recent gains from increased funding status and interest rates.

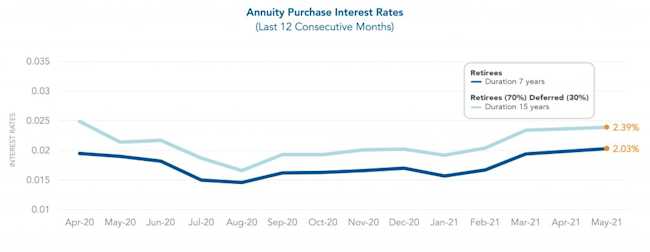

May 2021 Rates | ||

Duration: | 7 Years | 15 Years |

Range Rate: | 1.84% – 2.39% | 2.19% – 2.65% |

Average Rate: | 2.03% | 2.39% |

Average Rate Past Month Increase/Decrease: | - 0.14% | - 0.08% |

Average Rate During 2020: | 1.74% | 2.05% |

Average Rate YTD Increase/Decrease: | 0.46% | 0.47% |

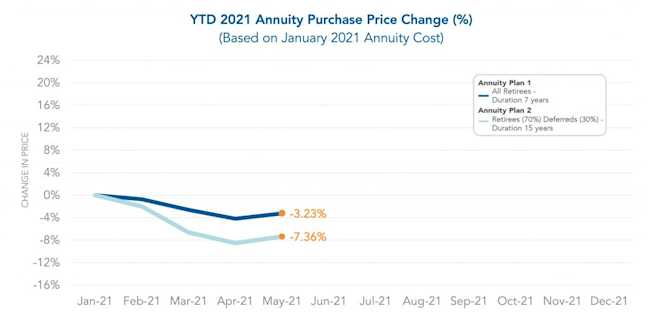

May 2021 Plan Tracker | ||

Plan: | Plan 1 | Plan 2 |

Annuity Purchase Price – YTD: | - 3.23% | - 7.36% |

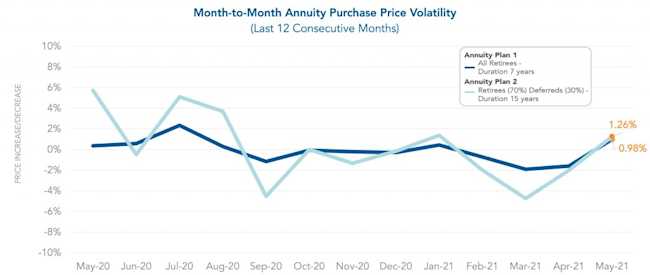

Annuity Purchase Price – Past Month: | +0.98% | +1.26% |

% Annuity Purchase Price Exceeds GAAP PBO: | 3.67% | 10.12% |

% Annuity Purchase Price Exceeds GAAP PBO – Past Month: | +0.36% | - 0.38% |

Narrative

Despite the persistence of the pandemic, it is clear that the outlook for plan sponsors is currently trending positively. Equity markets are strong and interest rates are rising. This is leading to improved plan funding statuses and lower annuity purchase prices.

The American Rescue Plan Act of 2021 (ARPA) will provide significant funding relief to plan sponsors by increasing the interest rates used for minimum funding liabilities and increasing the amortization periods for shortfalls. However, plans that pay PBGC Variable Rate Premiums (VRPs) will also experience substantial increases in PBGC VRPs as well, as PBGC liabilities are not impacted by ARPA.

The 4th quarter of 2020 further instilled the importance of initiating the annuity purchase process as early as possible. Plan sponsors that started the process early in 2020 were able to benefit from maximal insurer participation and optimal pricing for their transaction.

As mentioned in the April 2021 Pension Finance Update, pension plan funding statuses improved in March. The average duration 7 annuity purchase interest rates decreased 14 basis points and average duration 15 rates decreased 8 basis point since last month (as seen in the below graph titled Annuity Purchase Interest Rates).

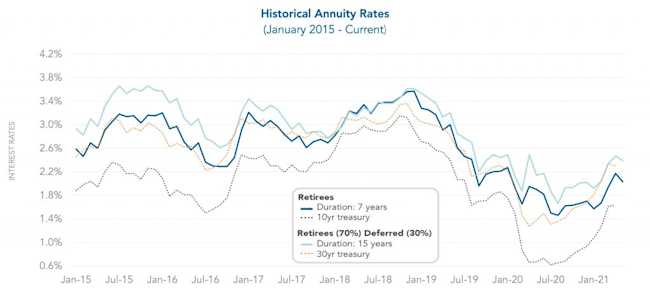

Annuity purchase interest rates fluctuate over time exhibiting varying degrees of peaks and valleys. This is evident in our graph below titled Historical Annuity Rates. We are currently experiencing an upward trend in interest rates. Plan sponsors should consider getting their data in order for a Pension Risk Transfer. Implementing a Pension Risk Transfer strategy can help a plan sponsor fulfill organizational goals, including reducing volatility in financial disclosures due to volatile interest rates.

The spread of annuity purchase prices above the GAAP projected benefit obligation (PBO) is in line with historical averages. (We refer to GAAP PBO and accounting book value interchangeably.) In May 2021, the spread for Annuity Plan 1 is 3.67% and the spread for Annuity Plan 2 is 10.12% as seen in the below graph. An increase in annuity purchase rates generally lowers annuity purchase prices relative to accounting book value. Keep in mind that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs. Future overhead costs would narrow the spread, though the extent is plan specific.

This past year, significant month-to-month cost volatility has persisted. In the past month the annuity purchase price for Annuity Plan 1 increased 0.98% and Annuity Plan 2 decreased 1.26% as seen in the below graph. Timing an early entrance to the insurance market is a crucial part of the planning stage because of the consistent short-term volatility of annuity pricing. Sponsors can take advantage of favorable fluctuations in a volatile market by connecting with an annuity search firm early.

Additional Risk Mitigation Strategies to Consider

Annuity purchases for plan sponsors do not need to occur on an all-or-nothing basis. Many plan sponsors can benefit by purchasing annuities even for a subset of plan participants. This is especially true for retirees with small benefit amounts. Plan sponsors pay PBGC premiums for participants that do not vary based on the size of the participant’s benefit. For retirees with small benefit amounts, the PBGC premium overhead burden is substantial and can be eliminated through an annuity purchase.

Have a pension risk transfer need but not sure where to start? See our article, What to Look for in an Annuity Search Firm.

October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed 2 hypothetical annuity plans which have been valued using the latest mortality tables and mortality improvement scales. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual PRT market activity and the corresponding impact on pension plans.